45 coupon rate bond calculator

Quant Bonds - Between Coupon Dates - BetterSolutions.com Price Between Coupon Dates You can calculate the price of a bond for dates between coupon dates by 1) Using the PRICE function. 2) Using the YIELD function - uses clean price as an argument SS What is the Clean Price ? Also known as the Flat Price, Quoted Price This is the price excluding any accrued income Traders usually quote clean prices I Bonds Rates Will Increase To 9.62% (May 2022 Update ... Using the formula below, we can determine the minimum rate an I Bond buyer would get starting in November 2021: Total rate = Fixed rate + 2 x Semiannual inflation rate + (Semiannual inflation rate X Fixed rate) Total rate = 0.000 + 2 x 3.56 + (3.56 x 0) Total rate = 7.12% November 2021 - April 2022 I Bond Rates

How Can I Calculate a Bond's Coupon Rate in Excel? In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a...

Coupon rate bond calculator

Inverse Floaters | Coupon Formula, Calculation & Example | eFM Coupon Rate = 20% - (2 x 3 month treasury bill rate) Now suppose we want to calculate the coupon rate as on March 5, 2018. 3-month treasury bill rate as on March 5, 2018, = 1.67%. Therefore Coupon Rate = 20% - (2 x 1.67%) = 20% - 3.34% = 13.66%. From the formula, we can come to a conclusion that when the reference rate goes up, the coupon ... How to Perform Bond Valuation with Python | by Bee Guan ... The YTM of the bond is about 7.89%. Since the bond coupon rate (5%) is less than its YTM, the bond is selling at a discount. On another hand, if the coupon rate is more than its YTM, the bond is selling at a premium. YTM is useful for an investor to determine if a bond is purchased with a good deal. Bond Pricing | Valuation | Formula | How to calculate with ... Calculate the price of a bond whose face value is $1000, the coupon rate is 10% and will mature after 5 years. The required rate of return is 8%. Coupon payment every year is $1000*10% = $100 every year for a period of 5 years. Hence, Therefore, the value of the bond (V) = $1079.8. The following is the summary of bond pricing:

Coupon rate bond calculator. Coupon Rate - Meaning, Example, Types | Yield to Maturity ... Coupon = 0.09 X 500.00 = USD 45.00. This means that bondholders of this bond will get USD 45.00 every year up until 2024 i.e. year of maturity. The tricky thing is the coupon rate of a bond also affects the price of the bonds in the secondary market. The bonds price is sensitive to the coupon rate. At this point, we can discuss the different ... 14.4: Debt Retirement and Amortization - Mathematics ... Step 1: Identify the face value of the bond and the coupon rate. Step 2: If the sinking fund payment ( P M T) and payment frequency ( P Y) are known, skip to step 4. Otherwise, draw a timeline for the sinking fund and identify known variables. Step 3: Calculate the sinking fund payment using Formula 11.4. Step 4: Calculate the annual cost of ... Coupon Rate Calculator | Bond Coupon Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Calculating Tax Equivalent Yield on Municipal Bonds Here's how you calculate the TEY in a few steps: Find the reciprocal of your tax rate (1 - your tax rate). If you pay 25% tax, your reciprocal would be (1 - .25) = .75, or 75%. Divide this amount into the yield on the tax-free bond to find out the TEY. For example, if the bond in question yields 3%, use (3.0 / .75) = 4%.

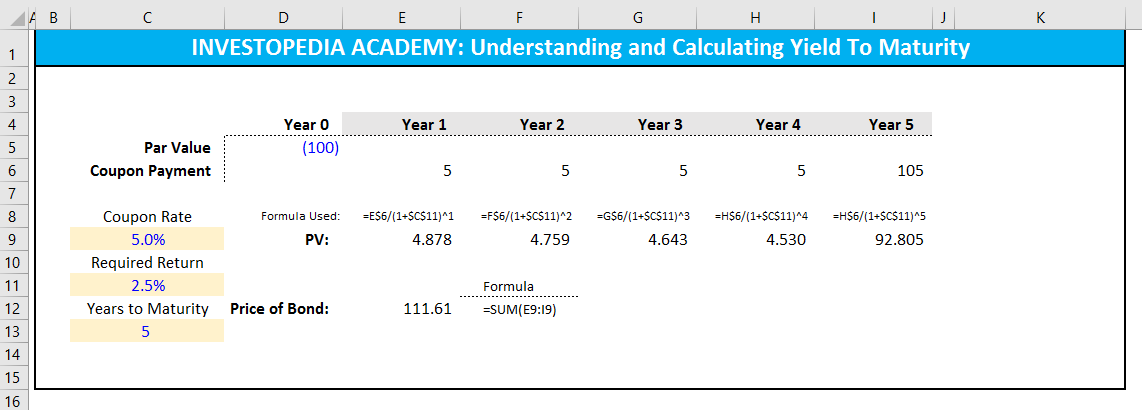

Yield to Maturity Calculator | Calculate YTM In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year. Determine the years to maturity The n is the number of years from now until the bond matures. Treasury Return Calculator, With Coupon Reinvestment Treasury Return Calculator, With Coupon Reinvestment The Treasury Return Calculator below uses long run 10-year Treasury Data from Robert Shiller to compute returns based on reinvesting the coupon payments. You can see the total returns for the 10 Year Treasury for any arbitrary period from 1871 until today. Coupon Rate - Meaning, Calculation and Importance To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders. Coupon Payment Calculator Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50 With the coupon payment calculator, you can find the periodic coupon payment for any bond by simply inputting the number of payments per year on the bond indenture.

Zero-Coupon Bond Value | Formula, Example, Analysis ... Let's say a $50,000 bond with a 5% coupon rate pays $2,500 in annual interest, irrespective of the bond's current price. However, if the interest rate increases to, say, 7%, the newly issued bonds with a $50,000 face value will pay an annual interest of $3,500. ... You can use the zero-coupon bond value calculator below to quickly measure ... What Is the Coupon Rate of a Bond? The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. Understanding Coupon Rate and Yield to Maturity of Bonds ... To translate this to quarterly payment, first, multiply the coupon rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly. Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator This calculator calculates the coupon rate using face value, coupon payment values.

[Solved] 1. A $1,000 bond has a coupon rate of 4 percent and matures after ten years. a) What is ...

Bond Valuation: Formula, Steps & Examples - Study.com Bond Terms. Horse Rocket Software has issued a five-year bond with a face value of $1,000 and a 10% coupon rate. Interest is paid annually. Similar bonds in the market have a discount rate of 12%.

Yield of a Coupon Bond calculation using Excel. How to ... How to calculate Yield of a Coupon Bond? byTameem May 25, 2021. Calculating the Yield of a Coupon Bond using Excel. ... So let's say that you bought a five-year bond with a coupon rate of 4% and let's say that it made annual interest payments this isn't some kind of semi-annual thing.

Coupon Rate Definition - investopedia.com A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

Treasury Bonds | CBK This calculator allows you determine what your payment would be based on the bond's face value, coupon rate, quoted yield and tenor. This calculator allows you to determine the price of a bond that is re-opened or sold on the secondary market. Find the bond's coupon rate, maturity date and issue date using our Treasury Bonds Results table ...

Zero Coupon Bond Calculator - Calculator Academy The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t where ZCBV is the zero-coupon bond value F is the face value of the bond r is the yield/rate t is the time to maturity Zero Coupon Bond Definition

Zero Coupon Bond Formula : Accounts and Finance Formulas / Its yield results from the difference ...

How to Calculate the Yield of a Zero Coupon Bond Using ... So We have 1.07. So we're gonna multiply 1.07 by the next term (1 + the forward rate) rate for year two. What's the forward rate for year two? It's 6.8%. So we're just taking (1 + the forward rate) for each of these periods. It's a five-year zero-coupon bond so we're gonna go all the way up to forward rate through year five.

Important Differences Between Coupon and Yield to Maturity Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

Coupon Rate: Definition, Formula & Calculation - Video ... Coupon rates are used in the realm of fixed-income investing, mainly when dealing with bonds. The coupon rate is the annualized coupon divided by par value. ... How to Calculate YTM

Bond Pricing | Valuation | Formula | How to calculate with ... Calculate the price of a bond whose face value is $1000, the coupon rate is 10% and will mature after 5 years. The required rate of return is 8%. Coupon payment every year is $1000*10% = $100 every year for a period of 5 years. Hence, Therefore, the value of the bond (V) = $1079.8. The following is the summary of bond pricing:

How to Perform Bond Valuation with Python | by Bee Guan ... The YTM of the bond is about 7.89%. Since the bond coupon rate (5%) is less than its YTM, the bond is selling at a discount. On another hand, if the coupon rate is more than its YTM, the bond is selling at a premium. YTM is useful for an investor to determine if a bond is purchased with a good deal.

Inverse Floaters | Coupon Formula, Calculation & Example | eFM Coupon Rate = 20% - (2 x 3 month treasury bill rate) Now suppose we want to calculate the coupon rate as on March 5, 2018. 3-month treasury bill rate as on March 5, 2018, = 1.67%. Therefore Coupon Rate = 20% - (2 x 1.67%) = 20% - 3.34% = 13.66%. From the formula, we can come to a conclusion that when the reference rate goes up, the coupon ...

Post a Comment for "45 coupon rate bond calculator"