42 what is bond coupon rate

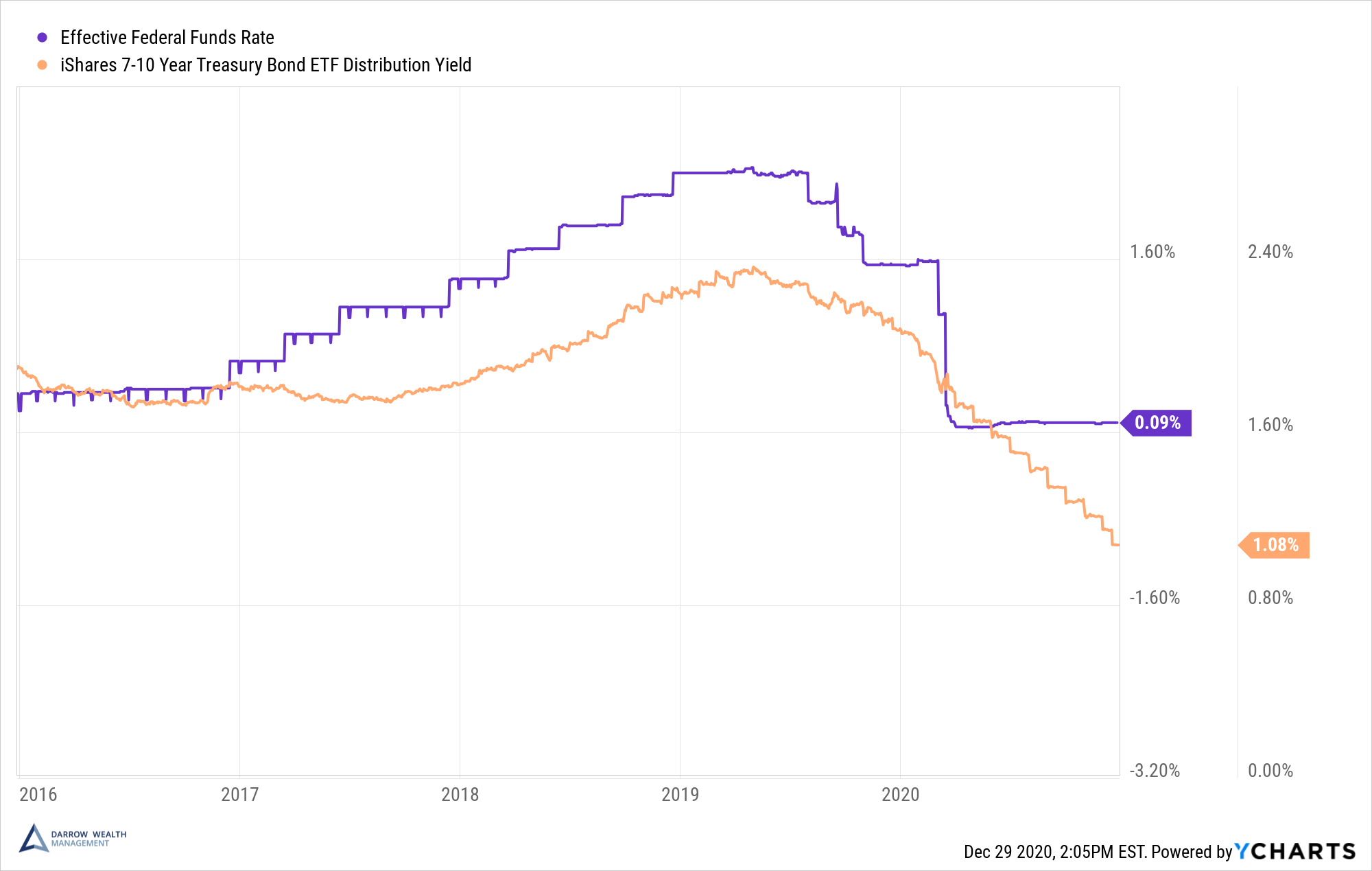

WHAT IS COUPON RATE OF A BOND - The Fixed Income A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment. What is a Coupon Rate? | Bond Investing | Investment U Coupon rates are the static variable in a dynamic bond market. This makes them an important variable in establishing market rates. The Inverse Relationship Between Price and Yield As bond prices fluctuate and coupon rates stay the same, the yield of a bond changes. This is an extremely important consideration because it changes the value of a bond.

Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50.

What is bond coupon rate

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity... Coupon Rate Structure of Bonds — Valuation Academy Coupon Rate Structure of Bonds A Coupon is the payment that the bond issuer pays the bond holder at certain frequency. Normally the coupon is paid semi-annually or annually. Some of the most common types of Bonds based on their coupon rate structures are: 1) Fixed Rate Bonds have a constant coupon rate throughout the life of the bond. Bond coupon rate calculator - ShamleeAeden Bonds coupon rate interest rate. Enter the bonds trading price face or par value time to maturity and coupon or stated interest rate to compute. The Calculator will price paper bonds of these series. On this page is a bond yield calculator to calculate the current yield of a bond. With all the inputs ready we can now calculate the coupon rate ...

What is bond coupon rate. Coupon Bond - Guide, Examples, How Coupon Bonds Work These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields on their investment. In the past, such bonds were issued in the form of bearer certificates. This means that the physical possession of the certificate was sufficient proof of ownership. Difference Between Coupon Rate and Discount Rate Securities with low coupon rates will have higher Discount rate hazards than securities that have higher coupon rates. Loan Process If the financial backer buys an obligation of 10 years, of the assumed worth of $1,000, and a coupon pace of 10%, then, at that point, the bond buyer gets $100 consistently as coupon installments on the bond. What is a Coupon Rate? (with picture) - Smart Capital Mind The coupon rate, also called the coupon, is the yearly interest rate payout on a bond that is communicated as a percentage of the value of the bond. Some bonds, called zero coupon bonds, are issued for less than face value and assigned no coupon rate. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

What is 'Coupon Rate' - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same. Bond Price Calculator c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity. After the bond price is determined the tool also checks how the bond should sell in comparison to the other similar bonds on the market by these rules: What Is Coupon Rate and How Do You Calculate It? - Accounting Services A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond with a coupon rate of 6% pays ...

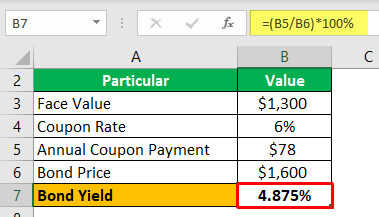

What Is a Coupon Rate? And How Does It Affects the Price of a Bond ... Coupon rate = $500 / $1,000 = 0.05 The bond's coupon rate is 5 percent. This is the portion of bond that shall be paid every year. How the Coupon Rate Affects the Price of a Bond? Every type of bonds does pay interest to bondholder. Such amount of interest is called coupon rate of interest. The coupon rate is fixed over time. What is a Coupon Rate? - Definition | Meaning | Example For example, the rate of a government bond is usually paid once a year, but if it is a U.S. bond the payment is made twice a year. Other bonds may pay interest every three months. In order to calculate the coupon rate formula of a bond, we need to know: the face value of the bond, the annual coupon rate, and the number of periods per annum. Coupon Rate Definition & Example | InvestingAnswers The coupon rate on the bond is 5%, which means the issuer will pay you 5% interest per year, or $50, on the face value of the bond ($1,000 x 0.05). Even if your bond trades for less than $1,000 (or more than $1,000), the issuer is still responsible for paying the coupon based on the face value of the bond. Coupon Rate: Formula and Bond Nominal Yield Calculator [Excel Template] The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

Coupon Rate - Meaning, Calculation and Importance - Scripbox The bond's coupon rate refers to the amount of annual interest the bondholder receives from the bond's issuer. Coupon rates are a percentage of the bond's face value (par value) and are set while issuing the bond. Moreover, the coupon payments are fixed for a bond throughout its tenure.

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

Coupon Rate Calculator | Bond Coupon coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! What is the difference between bond coupon rate and yield to maturity (YTM)?

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link

Understanding the Relationship Between Coupon Rates and Duration A high coupon rate bond provides more cash flow than a low coupon rate bond. Accordingly, a high coupon rate bond has a lower duration that a low coupon bond. For example, if I purchase a zero-coupon bond on its issue date the bond will have a duration of 30 years - no cash flow until the bond matures.

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate Coupon Rate is referred to the stated rate of interest on fixed income securities such as bonds. In other words, it is the rate of interest that the bond issuers pay to the bondholders for their investment. It is the periodic rate of interest paid on the bond's face value to its purchasers.

How To Find Coupon Rate Of A Bond On Financial Calculator How to Calculate Coupon Rate of a Bond On A Financial Calculator: The coupon rate is the interest that a bond pays per year, divided by the bond's face value. For example, if a bond has a face value of $1,000 and pays a coupon rate of 5%, then the bond will pay $50 in interest each year.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset What Is Coupon Rate and How Do You Calculate It? Bond coupon rate dictates the interest income a bond will pay annually. We explain how to calculate this rate, and how it affects bond prices. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators

Individual - Treasury Bonds: Rates & Terms The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .) The price of a fixed rate security depends on its yield to maturity and the interest rate.

Coupon Types - Financial Edge With a fixed-rate bond such as a 10-year, 3% coupon annual bond, the investor knows exactly what interest payments will be received every year until maturity. This is assuming that the bond issuer does not default at any point in time. There is a special type of fixed-rate bond called a zero-coupon bond.

Bond coupon rate calculator - ShamleeAeden Bonds coupon rate interest rate. Enter the bonds trading price face or par value time to maturity and coupon or stated interest rate to compute. The Calculator will price paper bonds of these series. On this page is a bond yield calculator to calculate the current yield of a bond. With all the inputs ready we can now calculate the coupon rate ...

Coupon Rate Structure of Bonds — Valuation Academy Coupon Rate Structure of Bonds A Coupon is the payment that the bond issuer pays the bond holder at certain frequency. Normally the coupon is paid semi-annually or annually. Some of the most common types of Bonds based on their coupon rate structures are: 1) Fixed Rate Bonds have a constant coupon rate throughout the life of the bond.

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

![Coupon Rate: Formula and Bond Yield Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/02/10222811/Coupon-Rate-Formula-960x300.jpg)

![Zero-Coupon Bond: Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/01/28183250/Zero-Coupon-Bonds-Formula.jpg)

![Yield to Maturity (YTM): Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/01/19095826/Yield-to-Maturity-YTM-Formula-960x400.jpg)

Post a Comment for "42 what is bond coupon rate"