45 irs quarterly payment coupon

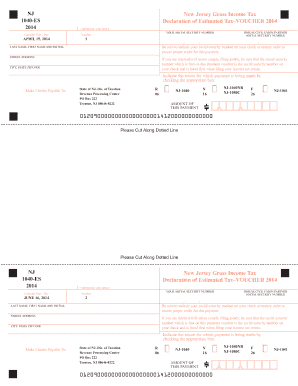

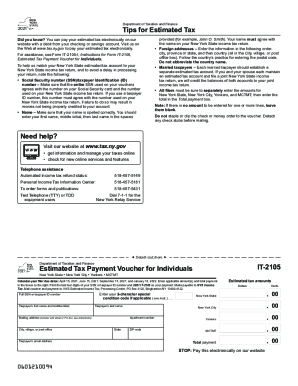

› publications › p523Publication 523 (2021), Selling Your Home | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. PDF Form IT-2105 Estimated Income Tax Payment Voucher Tax Year 2022 Enter applicable amount(s) and total payment in the boxes to the right. Print the last four digits of your SSN or taxpayer ID number and 2022 IT‑2105 on your payment. Make payable to NYS Income Tax. Mail voucher and payment to: NYS Estimated Income Tax, Processing Center, PO Box 4122, Binghamton NY 13902-4122. Enter your 2-character special

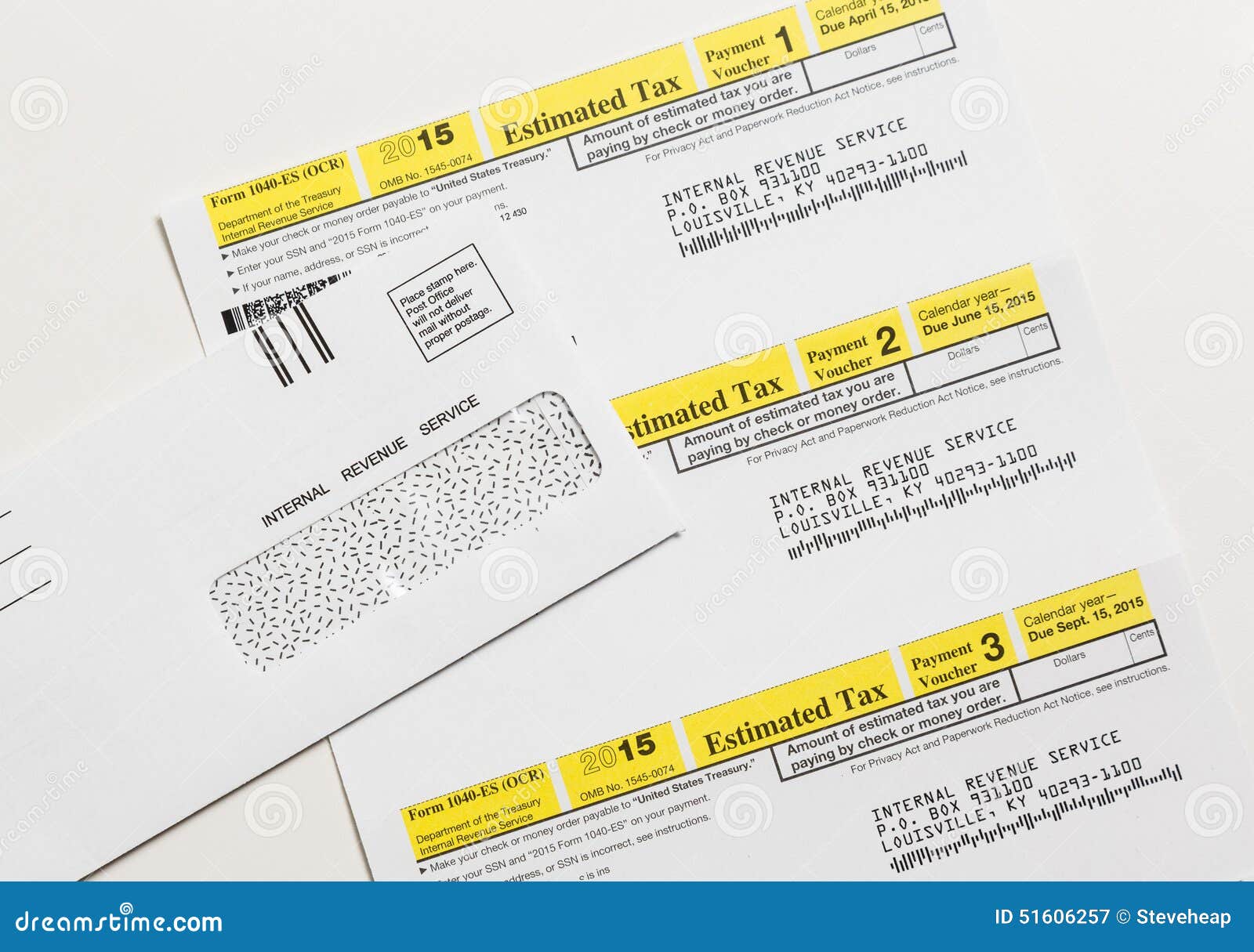

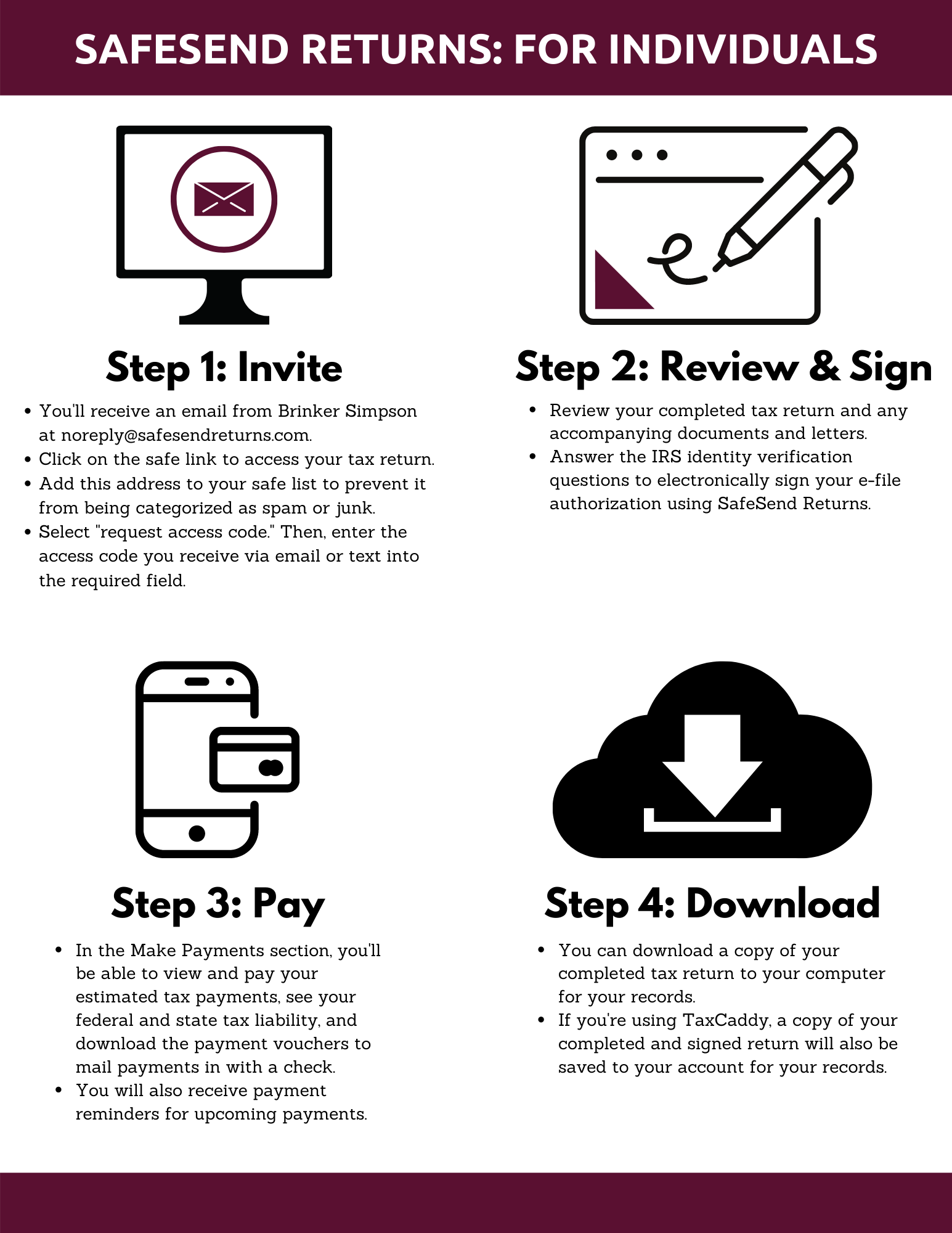

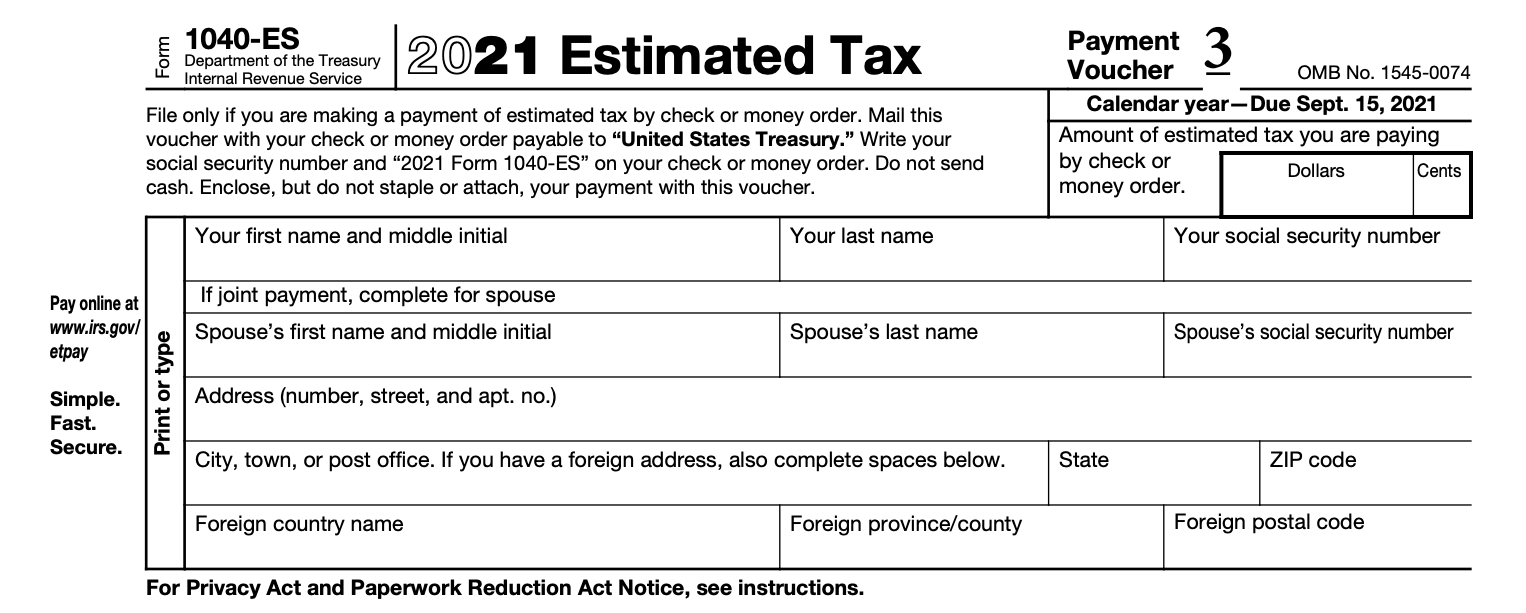

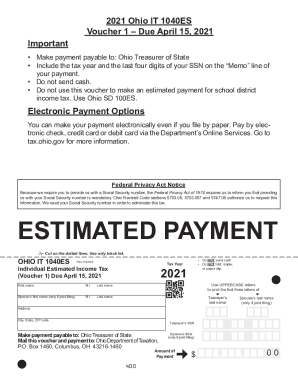

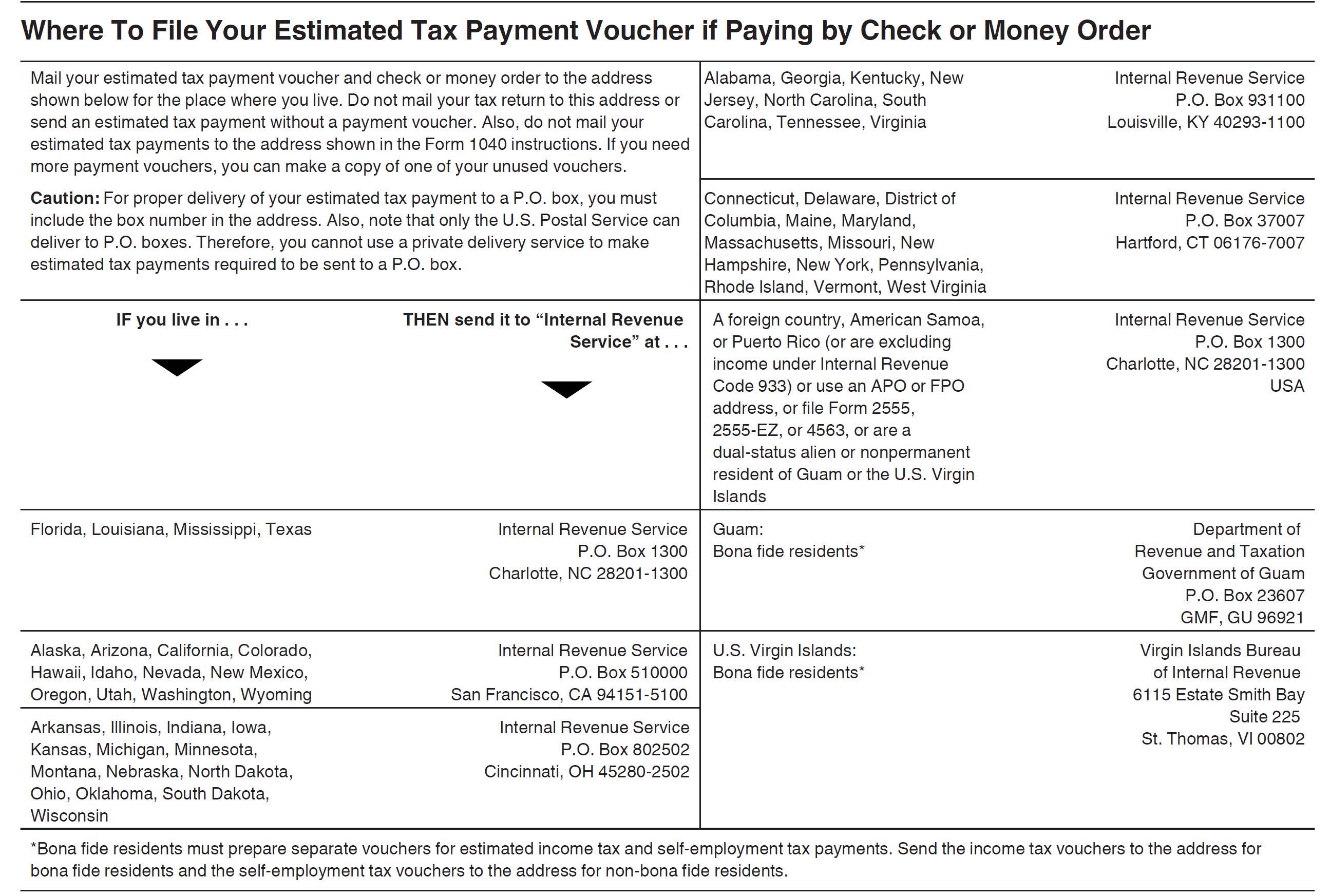

PDF 2022 Form 1040-ES - IRS tax forms Internal Revenue Service Purpose of This Package Use Form 1040-ES to figure and pay your estimated tax for 2022. Estimated tax is the method used to pay tax on income that isn't subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.). In addition, if you don't elect voluntary withholding,

Irs quarterly payment coupon

Estimated Income Tax Payments for 2022 and 2023 - Pay Online - e-File Sep 08, 2022 · The IRS may apply a penalty if you didn’t pay enough estimated taxes for the year, you didn’t pay the required estimate amount, or didn't pay on time. Form 1040-ES and Payment Methods You can make 1040-ES estimated tax payments online at the IRS , thus there is no need to e-File Form 1040-ES for the any of the quarters. About Form 1040-V, Payment Voucher | Internal Revenue Service Information about Form 1040-V, Payment Voucher, including recent updates, related forms and instructions on how to file. Submit this statement with your check or money order for any balance due on the "Amount you owe" line of your Form 1040 or Form 1040-SR, or 1040-NR. IRS: Sept. 15 is the deadline for third quarter estimated tax payments ... IR-2022-157, September 6, 2022 WASHINGTON — The Internal Revenue Service reminds taxpayers who pay estimated taxes that the deadline to submit their third quarter payment is September 15, 2022. Taxpayers not subject to withholding, such as those who are self-employed, investors or retirees, may need to make quarterly estimated tax payments.

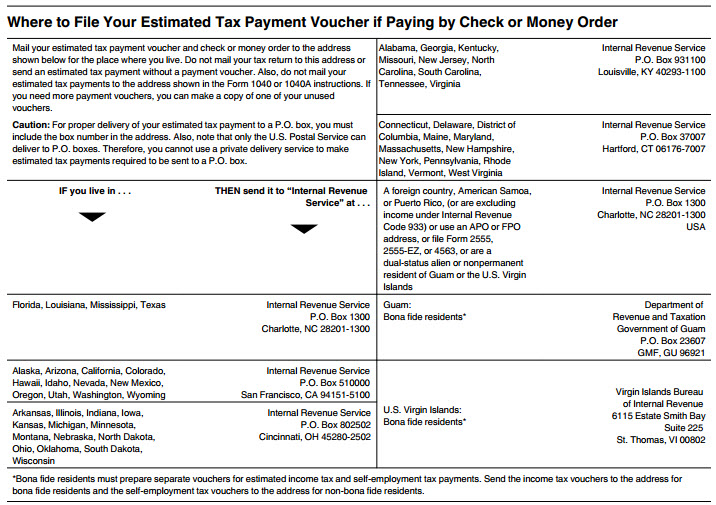

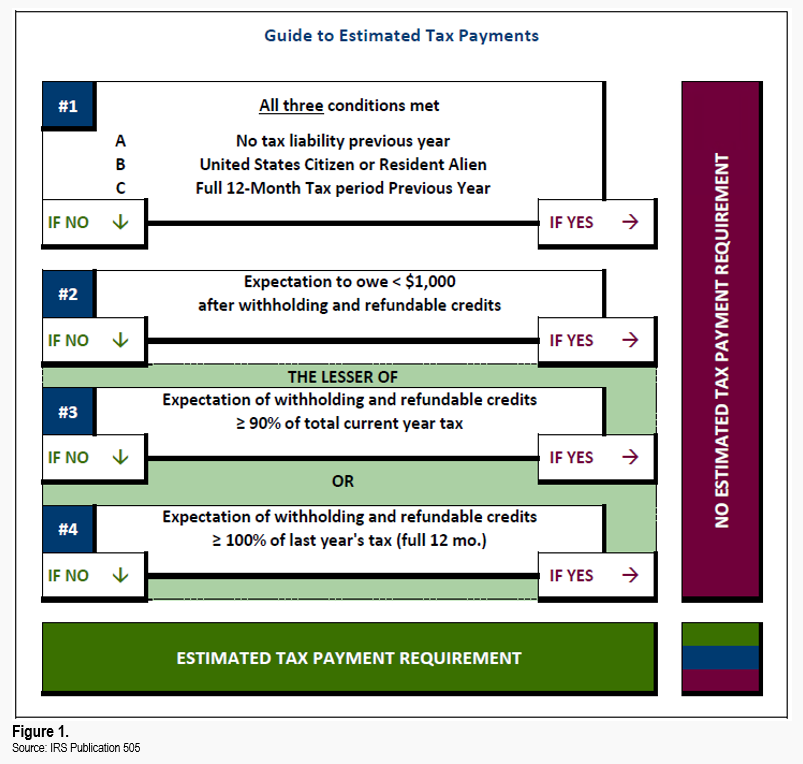

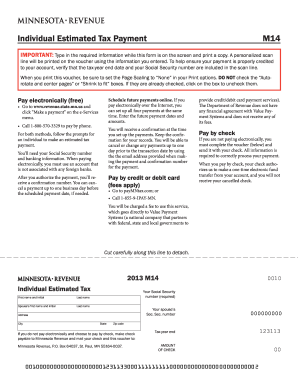

Irs quarterly payment coupon. 2022 Form 1040-ES - IRS tax forms Go to IRS.gov/Payments to see all your payment options. General Rule In most cases, you must pay estimated tax for 2022 if both of the following apply. 1. You expect to owe at least $1,000 in tax for 2022, after subtracting your withholding and refundable credits. 2. You expect your withholding and refundable credits PDF Employer's Quarterly Tax Payment Coupon UIA 1028 (Employer's Quarterly Wage/Tax Report). Make your check/money order payable to: Unemployment Insurance Agency (UIA). In order to ensure your account is properly credited, please include your 10-digit UIA Employer Account Number on your check or money order. In order to avoid penalties and interest, your tax return and payment must be ... Make a Payment | Minnesota Department of Revenue Individuals: Use the e-Services Payment System Some tax software lets you make or schedule payments when you file. To cancel a payment made through tax software, you must contact us. Call 651-556-3000 or 1-800-657-3666 (toll-free) at least three business days before the scheduled payment date. Businesses: Log in to e-Services › irm › part2020.1.7 Information Return Penalties | Internal Revenue Service The IRS assesses penalties for cases referred by the SSA when there is a discrepancy between wages reported on Form W-2 and what is reported to the IRS on Forms 94X and Form 1040 Schedule H. SSA will make two attempts to contact the employer to resolve the discrepancy. If SSA is unable to resolve the discrepancy, the cases are sent to the IRS.

› payPayments | Internal Revenue Service - IRS tax forms For individuals only. View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments. Go to Your Account. › newsroom › irs-reminder-to-many-makeIRS reminder to many: Make final 2021 quarterly tax payment ... Jan 05, 2022 · IR-2022-03, January 5, 2022 — The IRS urges taxpayers to check into their options to avoid being subject to estimated tax penalties, which apply when someone underpays their taxes. 2022 1040-ES Form and Instructions (1040ES) - Income Tax Pro Roughly each quarter you will mail an estimated tax payment voucher with a check to the IRS. Here are the quarterly due dates for the 2022 tax year: April 18, 2022 June 15, 2022 September 15, 2022 January 17, 2023 Each quarterly estimated tax payment should be postmarked on or before the quarterly due date. Estimated Quarterly Tax Payments: 1040-ES Guide & Dates - TaxCure You can make quarterly payments through the EFTPS over the phone at 1-800-555-4477 or online. Before making a payment, you need to sign up for the service. Sign up online, or call the above phone number to have a signup form mailed to you. You need your name, Social Security number, and bank account details for online enrollment.

Payments | Internal Revenue Service - IRS tax forms Sep 21, 2022 · Pay your taxes, view your account or apply for a payment plan with the IRS. Service Outages: Check Back Later This service is having outages that may keep you from successfully completing your session. Check back later. ... Employer's Quarterly Federal Tax Return Form W-2; Employers engaged in a trade or business who pay compensation Online Payment Vouchers - esweb.revenue.louisiana.gov Welcome to the Louisiana Department of Revenue's Online Payment Voucher System. ... Tax Payment Voucher. Estimated Declaration Tax Voucher. Extension Payment Request Voucher. Select a Voucher Type. Select the type of voucher you wish to print from the list below or change who you wish to print a voucher for: Press Releases | U.S. Department of the Treasury Internal Revenue Service (IRS) Office of the Comptroller of the Currency (OCC) U.S. Mint. Office of Inspector General (OIG) Treasury Inspector General for Tax Administration (TIGTA) Special Inspector General for the Troubled Asset Relief Program (SIGTARP) Special Inspector General for Pandemic Recovery (SIGPR) Estimated tax payments | FTB.ca.gov - California Generally, you must make estimated tax payments if in 2022 you expect to owe at least: $500. $250 if married/RDP filing separately. And, you expect your withholding and credits to be less than the smaller of one of the following: 90% of the current year's tax. 100% of the prior year's tax (including alternative minimum tax)

› instructions › i1099intInstructions for Forms 1099-INT and 1099-OID (01/2022) Exempt recipients. You are not required to file Form 1099-INT for payments made to certain payees including, but not limited to, a corporation, a tax-exempt organization, any individual retirement arrangement (IRA), Archer medical savings account (MSA), Medicare Advantage MSA, health savings account (HSA), a U.S. agency, a state, the District of Columbia, a U.S. possession, a registered ...

› publications › p463Publication 463 (2021), Travel, Gift, and Car Expenses ... Go to IRS.gov/OrderForms to order current forms, instructions, and publications; call 800-829-3676 to order prior-year forms and instructions. The IRS will process your order for forms and publications as soon as possible. Don’t resubmit requests you’ve already sent us. You can get forms and publications faster online.

Third quarter estimated tax payments due Sept. 15 IR-2020-205, September 9, 2020. WASHINGTON — The Internal Revenue Service today reminded the self-employed, investors, retirees and others with income not subject to withholding that third quarter estimated tax payments for 2020 are due September 15. Taxes are paid as income is received during the year through withholding from pay, pension or ...

How to Pay Quarterly Taxes: 2022 Tax Guide - SmartAsset Before outlining how to pay quarterly taxes, you must first understand who owes quarterly taxes and why the IRS requires them. The U.S. tax system uses a pay-as-you-go income tax system. With this type of system, taxpayers pay taxes as they earn income. Therefore, the government can tax W-2 employees with withholdings and self-employed ...

Montana Individual Income Tax Payment Voucher (Form IT) Montana Individual Income Tax Payment Voucher (Form IT) 2021: 30-12-2021 11:47: Download: Available in our TransAction Portal (TAP)?mdocs-file=55943. Contact Customer Service ... You can request a payment plan for making tax payments through TAP. Requesting a payment plan requires you to be logged in. Learn more about Requesting a payment plan.

PDF 2022 Form OW-8-ES Oklahoma Individual Estimated Tax Year 2021 Worksheet ... After this estimated tax payment is processed, you will receive a pre-printed coupon each quarter. Please use the pre-printed coupon to make further tax payments. Name Address City State IP 2022 Mail this coupon, along with payment, to: Oklahoma Tax Commission - PO Box 269027 - Oklahoma City, OK 73126-9027

Estimated Taxes | Internal Revenue Service - IRS tax forms Coronavirus Aid, Relief, and Economic Security (CARES) Act permits self-employed individuals making estimated tax payments to defer the payment of 50% of the social security tax on net earnings from self-employment imposed for the period beginning on March 27, 2020 and ending December 31, 2020.

2022 Federal Quarterly Estimated Tax Payments | It's Your Yale 2022 Federal Quarterly Estimated Tax Payments Generally, the Internal Revenue Service (IRS) requires you to make quarterly estimated tax payments for calendar year 2022 if both of the following apply: you expect to owe at least $1,000 in federal tax for 2022, after subtracting federal tax withholding and refundable credits, and

For those who make estimated federal tax payments, the first quarter ... IR-2022-77, April 6, 2022 WASHINGTON — The Internal Revenue Service today reminds those who make estimated tax payments such as self-employed individuals, retirees, investors, businesses, corporations and others that the payment for the first quarter of 2022 is due Monday, April 18.

PDF Form CT-1040ES 2022 City, town, or post office State ZIP code Payment amount.00 See coupon instructions on back. (MM-DD-YYYY) Department of Revenue Services State of Connecticut Form CT-1040ES 2022 Estimated Connecticut Income Tax Payment Coupon for Individuals Complete this form in blue or black ink only. Please note that each form is year specific.

DOR Estimated Tax Payments | Mass.gov Unlike estimated payment vouchers, which have specific quarterly due dates, standard payment vouchers should only be used to submit a payment due with a tax return or amended tax return. Use a payment voucher when you are sending a paper check to DOR but your tax return has been filed electronically.

› publications › p15bPublication 15-B (2022), Employer's Tax Guide to Fringe ... Moving expense reimbursements. P.L. 115-97, Tax Cuts and Jobs Act, suspends the exclusion for qualified moving expense reimbursements from your employee's income for tax years beginning after 2017 and before 2026. However, the exclusion is still available in the case of a member of the U.S. Armed Forces on active duty who moves because of a permane

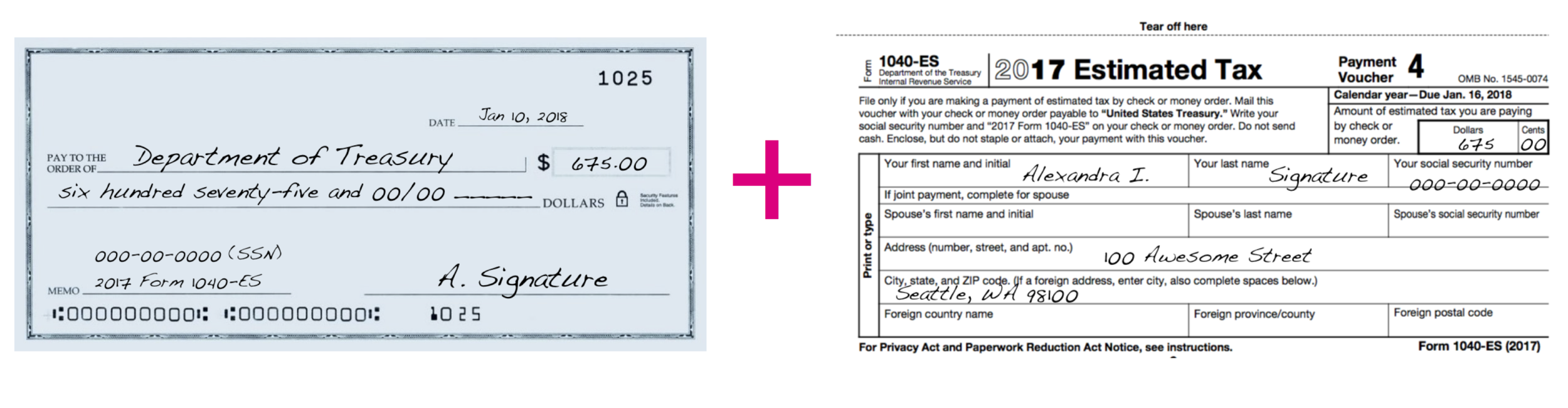

2022 Federal Quarterly Estimated Tax Payments | It's Your Yale Jun 01, 2013 · Generally, the Internal Revenue Service (IRS) requires you to make quarterly estimated tax payments for calendar year 2022 if both of the following apply: you expect to owe at least $1,000 in federal tax for 2022, after subtracting federal tax withholding and refundable credits, and ... You may mail your payment with payment voucher, Form 1040-ES;

IRS: Sept. 15 is the deadline for third quarter estimated tax payments ... IR-2022-157, September 6, 2022 WASHINGTON — The Internal Revenue Service reminds taxpayers who pay estimated taxes that the deadline to submit their third quarter payment is September 15, 2022. Taxpayers not subject to withholding, such as those who are self-employed, investors or retirees, may need to make quarterly estimated tax payments.

About Form 1040-V, Payment Voucher | Internal Revenue Service Information about Form 1040-V, Payment Voucher, including recent updates, related forms and instructions on how to file. Submit this statement with your check or money order for any balance due on the "Amount you owe" line of your Form 1040 or Form 1040-SR, or 1040-NR.

Estimated Income Tax Payments for 2022 and 2023 - Pay Online - e-File Sep 08, 2022 · The IRS may apply a penalty if you didn’t pay enough estimated taxes for the year, you didn’t pay the required estimate amount, or didn't pay on time. Form 1040-ES and Payment Methods You can make 1040-ES estimated tax payments online at the IRS , thus there is no need to e-File Form 1040-ES for the any of the quarters.

/1040-V-df038816cc244b248641f447493a030d.jpg)

/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)

Post a Comment for "45 irs quarterly payment coupon"