42 define zero coupon bond

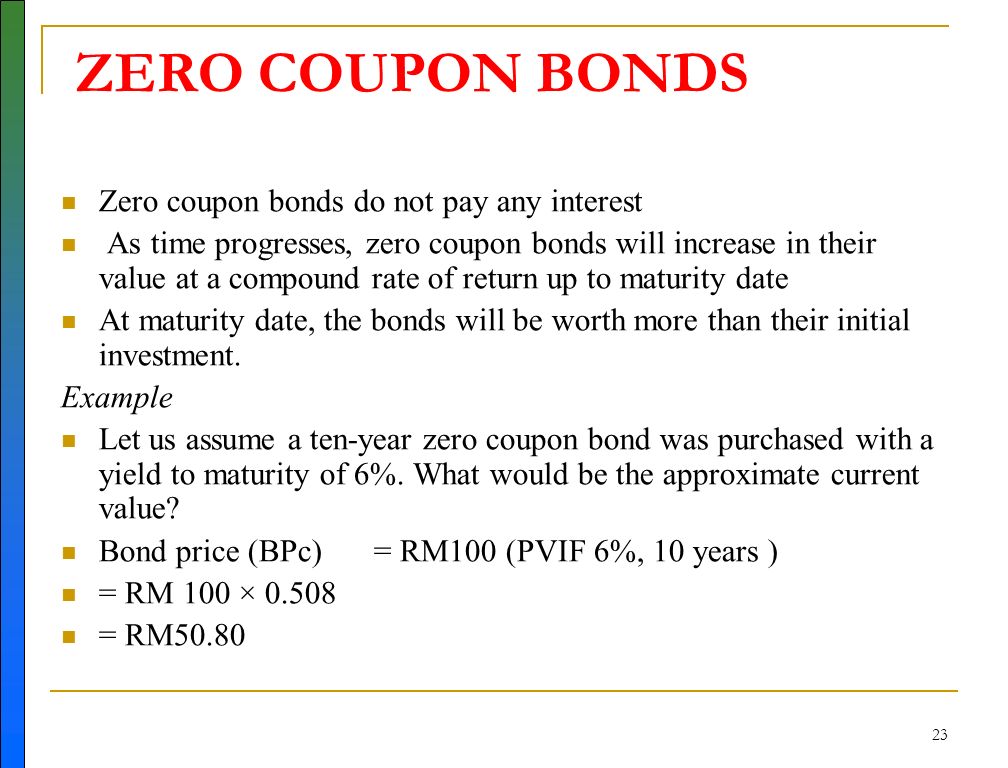

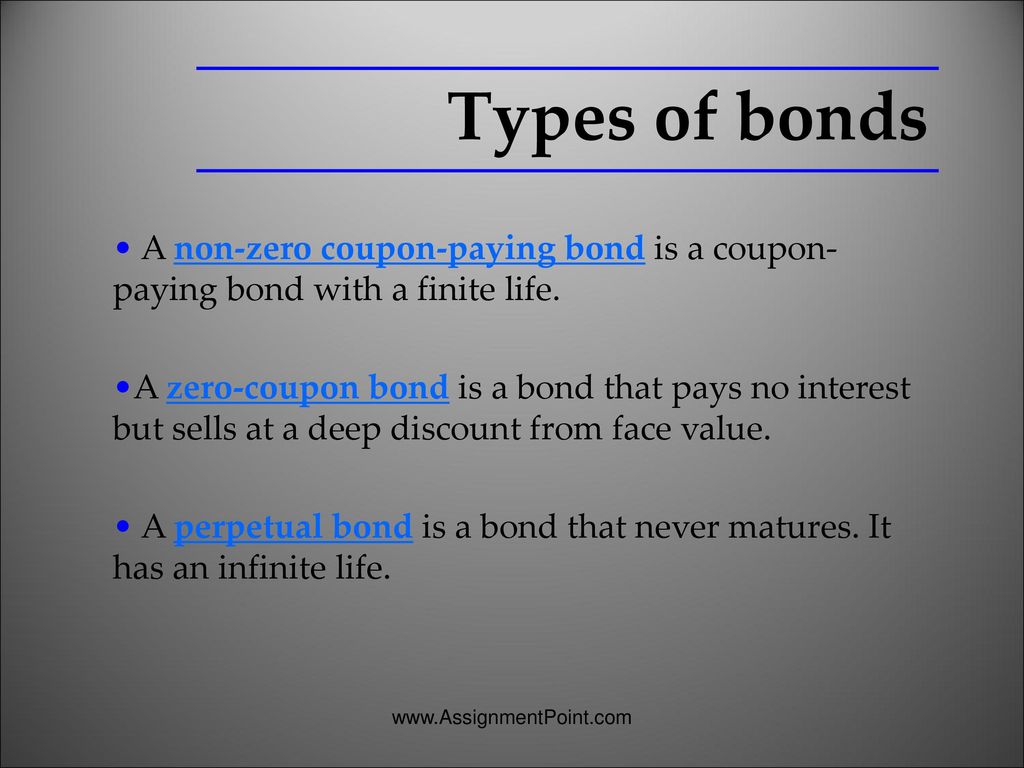

Zero Coupon Bonds financial definition of Zero Coupon Bonds A bond that provides no periodic interest payments to its owner. A zero-coupon bond is issued at a fraction of its par value (perhaps at $3 to $5 for each $100 of face value for a long-term bond) and increases gradually in value as it approaches maturity. Thus, an investor's income from a zero-coupon bond comes solely from appreciation in value. Technology and Science News - ABC News Oct 17, 2022 · Get the latest science news and technology news, read tech reviews and more at ABC News.

Zero-Coupon Bonds and Taxes - Investopedia A zero-coupon bond will usually have higher returns than a regular bond with the same maturity because of the shape of the yield curve. Zero-coupon bonds are more volatile than coupon...

Define zero coupon bond

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Like regular bonds, zero-coupon bonds are financial securities that mature over time, and their face (par) value is paid to their holder at the end of their term. Unlike coupon-paying... Zero-Coupon Bonds Definition | Law Insider Define Zero-Coupon Bonds. means the senior unsecured convertible zero-coupon bonds due 2021 issued by the Borrower on May 7, 2001. Zero Coupon Bonds - definition of Zero Coupon Bonds by The Free Dictionary Zero Coupon Bonds synonyms, Zero Coupon Bonds pronunciation, Zero Coupon Bonds translation, English dictionary definition of Zero Coupon Bonds. Noun 1. zero-coupon bond - a bond that is issued at a deep discount from its value at maturity and pays no interest during the life of the bond; the...

Define zero coupon bond. Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. [1] Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value. Definition of Zero Coupon Bond | AccountingMCQs.com What is the definition of zero coupon bonds? Companies, schools, and governments use bonds as a way to finance expansions and other long term projects. Usually the decision to issue a bond starts with a proposal for new projects. When the board or governing body approves the plans, a bond can be issued. Unfortunately, it isn't that easy. Answered: Define Zero-Coupon Bonds. | bartleby Solution for Define Zero-Coupon Bonds. Start your trial now! First week only $4.99! arrow_forward Zero-coupon bond - definition of zero-coupon bond by The Free Dictionary Noun 1. zero-coupon bond - a bond that is issued at a deep discount from its value at maturity and pays no interest during the life of the bond; the commonest form of zero-coupon security zero coupon bond

Zero Coupon Bond | Investor.gov Zero Coupon Bond Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for … Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond. Used cars and new cars for sale – Microsoft Start Autos - MSN Find new and used cars for sale on Microsoft Start Autos. Get a great deal on a great car, and all the information you need to make a smart purchase. Zero-coupon-bond definition - YourDictionary Define zero-coupon-bond. Zero-coupon-bond as a means A bond that pays no interest until it matures. It is priced at a deep discount to make up for the lack of income. These ....

Zero coupon bond financial definition of zero coupon bond A bond that provides no periodic interest payments to its owner. A zero-coupon bond is issued at a fraction of its par value (perhaps at $3 to $5 for each $100 of face value for a long-term bond) and increases gradually in value as it approaches maturity. Thus, an investor's income from a zero-coupon bond comes solely from appreciation in value. Zero Coupon Bond | Definition, Formula & Examples - Study.com A zero-coupon bond, which is also referred to as "an accrual bond", is a debt security that does not provide investors with periodic payments or periodic interests. Instead, this type of... Zero-Coupon Bond: Definition, How It Works, and How To Calculate A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference... › glossary › zero-coupon-bondZero Coupon Bond | Investor.gov Zero Coupon Bond Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten, fifteen, or more years.

DIY Seo Software - Locustware.com A.I. Advanced A.I. Content Writer $ 247 Our private A.I. tool requires no monthly subscription. Over 500,000 Words Free; The same A.I. Engine as all of the big players - But without the insane monthly fees and word limits.

en.wikipedia.org › wiki › Bootstrapping_(finance)Bootstrapping (finance) - Wikipedia In finance, bootstrapping is a method for constructing a (zero-coupon) fixed-income yield curve from the prices of a set of coupon-bearing products, e.g. bonds and swaps.. A bootstrapped curve, correspondingly, is one where the prices of the instruments used as an input to the curve, will be an exact output, when these same instruments are valued using this curve.

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value.

Zero coupon bond - definition of zero coupon bond by The Free Dictionary Noun 1. zero coupon bond - a bond that is issued at a deep discount from its value at maturity and pays no interest during the life of the bond; the commonest form of zero-coupon security zero-coupon bond

What is a Zero Coupon Bond? - Definition | Meaning | Example A Zero coupon bond is a bond that sells without a stated rate of interest. This way the company or government doesn't have to worry about changing interest rates. These bonds are sold at a discount don't pay a standard monthly interest percentage like normal bonds do. Instead, investors receive the gain of the appreciated bond at maturity.

› en-us › autosUsed cars and new cars for sale – Microsoft Start Autos - MSN Find new and used cars for sale on Microsoft Start Autos. Get a great deal on a great car, and all the information you need to make a smart purchase.

Designer Fashion, Accessories & More - Shop Online at Selfridges Voted the best department store in the world, Selfridges has all the latest designer collections, must-have toys & gifts for all the family.

› archivesInquirer.com: Philadelphia local news, sports, jobs, cars, homes Keep reading by creating a free account or signing in.. Sign in/Sign up; Subscribe; Support local news; News Sports Betting Business Opinion Politics Entertainment Life Food Health Real Estate Obituaries Jobs

Zero-coupon bonds financial definition of Zero-coupon bonds Zero-coupon bonds, especially issues with long maturities, tend to have very volatile prices. Buy a zero-coupon bond with a 25-year maturity and watch the price plummet if market interest rates increase. Of course, the opposite also holds true. A long-term zero-coupon bond will produce substantial gains in value when market rates of interest ...

abcnews.go.com › technologyTechnology and Science News - ABC News Oct 17, 2022 · Get the latest science news and technology news, read tech reviews and more at ABC News.

Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

Zero Coupon Covered Bonds Definition | Law Insider Define Zero Coupon Covered Bonds. means Covered Bonds which will be offered and sold at a discount to their nominal amount and which will not bear interest.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds are also known as Treasury zeros, and they often rise dramatically in price when stock prices fall. Zero-coupon U.S. Treasury bonds can move up...

locustware.comDIY Seo Software - Locustware.com DIY Seo Software. Looking for an affordable and easy-to-use SEO solution? Look no further than the Gseo DIY SEO Software. This powerful software solution provides everything you need to optimize your website for search engines, by providing you with the exact topically relevant keyword entities for your niche.

Bootstrapping (finance) - Wikipedia In finance, bootstrapping is a method for constructing a (zero-coupon) fixed-income yield curve from the prices of a set of coupon-bearing products, e.g. bonds and swaps.. A bootstrapped curve, correspondingly, is one where the prices of the instruments used as an input to the curve, will be an exact output, when these same instruments are valued using this curve.

Inquirer.com: Philadelphia local news, sports, jobs, cars, homes Keep reading by creating a free account or signing in.. Sign in/Sign up; Subscribe; Support local news; News Sports Betting Business Opinion Politics Entertainment Life Food Health Real Estate Obituaries Jobs

CBS MoneyWatch Oct 25, 2022 · Here's how much money Americans think they need for retirement Workers say they need 20% more than a year ago to retire, yet retirement savings are shrinking.

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. Zeros-coupon bonds are ideal for long-term, targeted...

Video Game News & Reviews | Engadget Find in-depth news and hands-on reviews of the latest video games, video consoles and accessories.

› createJoin LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

Zero-coupon bond financial definition of Zero-coupon bond Zero-Coupon Bond A bond that pays no interest. It is sold at a discount from par and matures at par. These are fairly illiquid investments because they do not benefit from changes in interest rates. However, they tend to be low- risk. Zero-coupon bonds fluctuate in price, sometimes dramatically, with changes in interest rates.

Zero Coupon Bonds - definition of Zero Coupon Bonds by The Free Dictionary Zero Coupon Bonds synonyms, Zero Coupon Bonds pronunciation, Zero Coupon Bonds translation, English dictionary definition of Zero Coupon Bonds. Noun 1. zero-coupon bond - a bond that is issued at a deep discount from its value at maturity and pays no interest during the life of the bond; the...

Zero-Coupon Bonds Definition | Law Insider Define Zero-Coupon Bonds. means the senior unsecured convertible zero-coupon bonds due 2021 issued by the Borrower on May 7, 2001.

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Like regular bonds, zero-coupon bonds are financial securities that mature over time, and their face (par) value is paid to their holder at the end of their term. Unlike coupon-paying...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "42 define zero coupon bond"