43 how to find the coupon payment

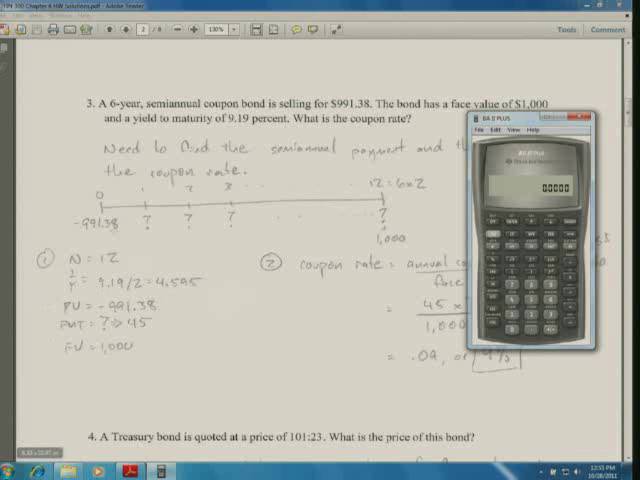

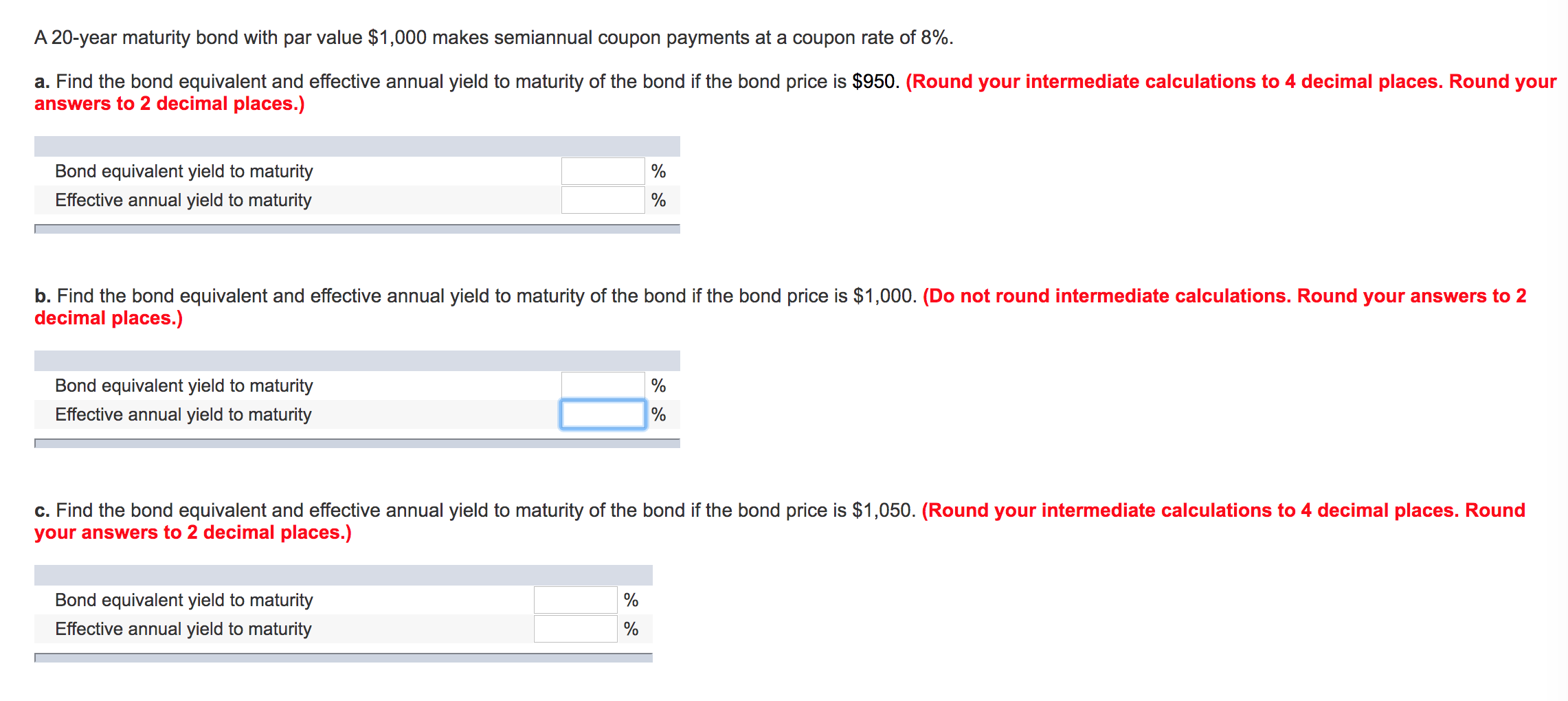

How To Find Coupon Rate Of A Bond On Financial Calculator Divide the coupon payment amount by the face value. Multiply the result by 100 to get the percentage. For example, you have a $1,000 bond with a $50 coupon payment. To calculate the coupon rate, you would divide $50 by $1,000 and multiply by 100. The result is 5%, which means the bond pays 5% interest per year. Conclusion Find the coupon date of a bond - Personal Finance & Money Stack Exchange It will pay periodic coupons starting from the issue date. You can also work backwards from the maturity date. In your example the bond matures on March 6, 2022 and pays interest annually (although I find conflicting data from other sites) so it pays interest every March 6th (plus or minus a few days depending on what the prospectus says).

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

How to find the coupon payment

How to Calculate a Coupon Payment - Stand 4 Aids Investors must know how to calculate the coupon bond payment to understand coupon finance. The formula is simple to understand, as explained in the example below. However, avoiding this is possible in three ways - buying municipal zero-coupon bonds, buying them in a tax-exempt account, or buying corporate zero-coupon bonds with tax-exempt status. Coupon Rate Calculator | Bond Coupon You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! How to Choose a Mattress for 2022 | Reviews by Wirecutter How to find a mattress you can happily sleep on for years.

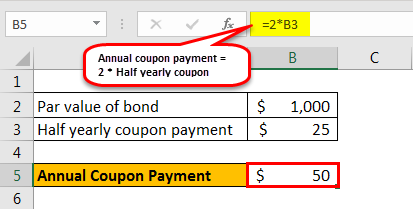

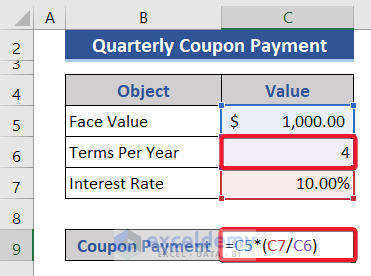

How to find the coupon payment. Coupon Rate Formula | Step by Step Calculation (with Examples) Total annual coupon payment = Periodic payment * No. of payments in a year Finally, the coupon rate is calculated by dividing the total annual coupon payment by the par value of the bond and multiplied by 100%, as shown above. Examples You can download this Coupon Rate Formula Excel Template here - Coupon Rate Formula Excel Template Example #1 Coupon Rate: Formula and Bond Calculation (Step-by-Step) - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell A3, enter the formula "=A1*A2" to yield the total annual coupon payment. Moving down the spreadsheet, enter the par value of your bond in cell B1. Most bonds have par values of $100 or ... How to Calculate Coupon Rate in Excel (3 Ideal Examples) 2. Calculate Coupon Rate with Monthly Interest in Excel. In the following example, we will calculate the coupon rate with monthly interest in Excel. This is pretty much the same as the previous example but with a basic change. Monthly interest means you need to pay the interest amount each month in a year. So, the number of payments becomes 12 ...

Coupon Rate Formula & Calculation - Study.com Calculate the annualized coupon payments by summing all the periodic payments made during a given year. Divide the annualized coupon payments by the par value. Convert the resulted... Amazon.com: Furbo Dog Camera: Treat Tossing, Full HD Wifi Pet ... UPDATE NOV 2020: I bought another one (when it was on sale for about 40% off, I would not pay full price if planning on using without premium features - Furbo's premium bundle may be a cheaper option if you are willing to shell out the full price) about a year and a half after my first purchase as I had to leave my first one behind in a different country when I returned home due to COVID ... How to Calculate a Coupon Payment | Sapling In finance, a coupon payment represents the interest that's paid on a fixed-income security such as a bond. Par value is the face value of a bond. Calculate the annual coupon rate by figuring the annual coupon payment, dividing this amount by the par value and multiplying by 100 percent. Coupon Payment Calculator Jul 08, 2022 · Using the coupon payment formula, you can find the coupon payment for any bond: Divide the annual coupon rate by the number of payments per year. For instance, if the bond pays semiannually, divide the coupon rate by 2. Multiply the result with the bond's face value to get the coupon payment.

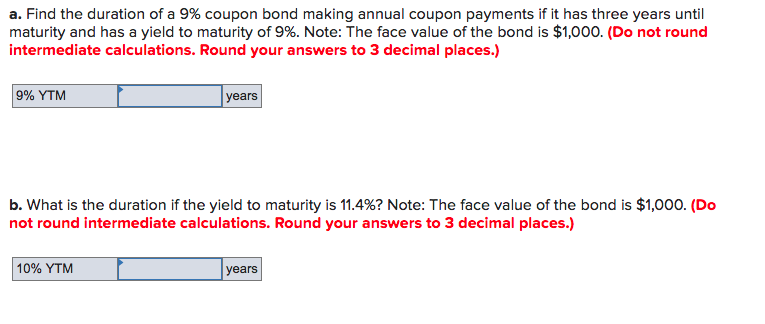

How to Calculate the Price of Coupon Bond? - WallStreetMojo The coupon payment is denoted by C, and it is calculated as C = Coupon rate * P / Frequency of coupon payment Next, determine the total number of periods till maturity by multiplying the frequency of the coupon payments during a year and the number of years till maturity. Literotica.com - Members - SZENSEI - Submissions Mar 08, 2017 · Mountain climbing just to find a Rose. Petals will fall! Exhibitionist & Voyeur 04/10/22: Cougar House Ep. 045: TURNING poINt (4.80) Early to bed, early to rise, that's the problem with all horny guys. Exhibitionist & Voyeur 04/17/22: Cougar House Ep. 046: Peak Performance (4.76) She'll be cumming on the mountain. She'll be cumming on the mountain. Kohl's Coupons: Promo Codes & Coupon Codes | Kohl's Save money at Kohl's with coupons, promo codes, Kohl's Cash and more! Keep up to date with all of the latest deals and discover promo codes for your favorite brands at Kohl's, including discounts on Under Armour and Nike shoes on sale.Find coupon codes on everything from discounted jewelry and shoes to Black Friday deals and gift ideas for birthdays and anniversaries. Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated by dividing Annual Coupon Payment by Face Value of Bond, the result is expressed in percentage form. The formula for Coupon Rate - Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Below are the steps to calculate the Coupon Rate of a bond:

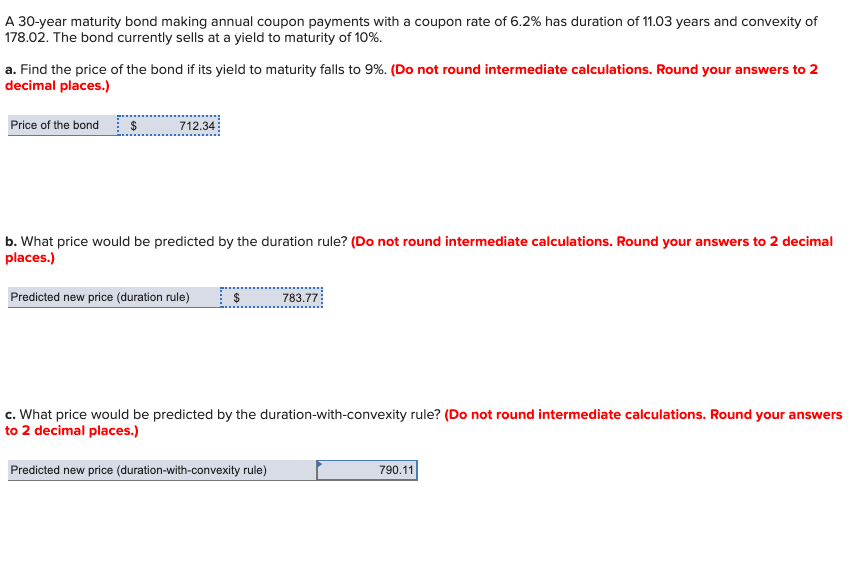

Bond Yield Formula | Step by Step Calculation & Examples - WallStreetMojo Here we must understand that this calculation completely depends on the annual coupon and bond price. It completely ignores the time value of money, frequency of payment, and amount value at the time of maturity. Step 1: Calculation of the coupon payment Annual Payment. =$1000*5%.

Coupon Payment | Definition, Formula, Calculator & Example Coupon payment for a period can be calculated using the following formula: Where F is the face value of the bond, c is the annual coupon rate and n represents the number of payments per year. Coupon Payment Calculator Example Walmart Stores Inc. has 3 million, $1,000 par value bonds payable due on 15th August 2037.

PPIC Statewide Survey: Californians and Their Government Oct 27, 2022 · Key Findings. California voters have now received their mail ballots, and the November 8 general election has entered its final stage. Amid rising prices and economic uncertainty—as well as deep partisan divisions over social and political issues—Californians are processing a great deal of information to help them choose state constitutional officers and state legislators and to make ...

How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value). For example, if you paid $800 for a bond and its current yield is 10%, your coupon payment is .1 * 800 or $80. [7] 3 Calculate the payment by frequency.

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Home | NextAdvisor with TIME NextUp. The 25 Most Influential New Voices of Money. This is NextUp: your guide to the future of financial advice and connection. Explore the list and hear their stories.

How To Calculate Coupon Payment - bizimkonak.com How to Calculate a Coupon Payment Sapling. CODES (6 days ago) In finance, a coupon payment represents the interest that's paid on a fixed-income security such as a bond. Par value is the face value of a bond. Calculate the annual coupon … Visit URL. Category: coupon codes Show All Coupons

Forms, Instructions and Publications | Internal Revenue Service The latest versions of IRS forms, instructions, and publications. View more information about Using IRS Forms, Instructions, Publications and Other Item Files.. Click on a column heading to sort the list by the contents of that column.

Coupon Bond Formula | Examples with Excel Template - EDUCBA Step 2: Next, figure out the rate of annual coupon and based on that calculate the periodic coupon payment of the bond. The coupon payment is the product of the coupon rate and the par value of the bond. It also does not change over the course of the bond tenure. The annual coupon payment is denoted by C and mathematically represented as shown ...

How to Choose a Mattress for 2022 | Reviews by Wirecutter How to find a mattress you can happily sleep on for years.

Coupon Rate Calculator | Bond Coupon You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time!

How to Calculate a Coupon Payment - Stand 4 Aids Investors must know how to calculate the coupon bond payment to understand coupon finance. The formula is simple to understand, as explained in the example below. However, avoiding this is possible in three ways - buying municipal zero-coupon bonds, buying them in a tax-exempt account, or buying corporate zero-coupon bonds with tax-exempt status.

Post a Comment for "43 how to find the coupon payment"